I talked last time about vehicle financing and leasing, and why equipment financing companies don’t finance passenger vehicles. The reason boiled down to these are not 100% business vehicles, and therefore come under the umbrella of “consumer debt” in the eyes of many, which almost all commercial lenders wish to avoid.

I talked last time about vehicle financing and leasing, and why equipment financing companies don’t finance passenger vehicles. The reason boiled down to these are not 100% business vehicles, and therefore come under the umbrella of “consumer debt” in the eyes of many, which almost all commercial lenders wish to avoid.

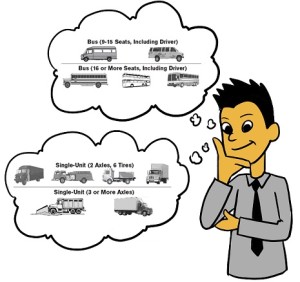

So that begs the question – just what kinds of vehicles DO equipment financing companies lease and/or finance? “Just about everything else” is the correct answer.

Really, the list of the types of vehicles that we do finance or lease is long indeed. In fact, you’d be hard pressed to call many of them “vehicles” in the classic sense, because you won’t see them on the road all that often (and if you do and are stuck behind one, you might be cursing the 20mph cruising speed many of these travel at!)

But let’s see… we have dump trucks, road graders, cranes, bucket trucks / cherry pickers, road pavers, steamrollers, septic pump trucks, oil delivery trucks, ambulances, cargo vans, large courtesy vans (like those used for a hotel), limousines, cube vans, glass transport trucks, street cleaners, cement mixers… that’s just off the top of my head. I’m leaving off a ton of things.

Then we get to trailers and similar. We finance lots of those. And “pull behind” accessories, like wood chippers, trailer-style generators, and similar. We also finance a lot of trucks, like smaller delivery trucks, all the way up to 18 wheelers. But here’s an interesting tidbit – we don’t finance 18 wheelers for transportation companies or owner operators (because that’s more or less fleet financing, which we don’t get involved in.) But if you’re a manufacturer who wants their own delivery truck, we’re good for that.

As you can see, there’s a lot to business vehicle financing and leasing. We have three posts on the subject now, and there’s room for one more – next time, we’ll talk about the reason why it’s advantageous to go through an equipment financing company.