Hello, finance enthusiasts!

Last week brought about significant changes to Section 179 of the US Tax Code, often referred to as the “Hummer tax break” in our previous discussions. Just to jog your memory, this provision allows businesses to purchase equipment and write off the entire cost, albeit with certain limits in place.

Well, the Economic Stimulus Act of 2008 was implemented last week. You’ve likely heard of this Act—it’s the one prompting Uncle Sam (my favorite uncle when such matters are involved) to send most of us a $600 check.

But the benefits of this Act don’t stop at individual taxpayers. There are also significant provisions for businesses, including an increase in the limits on Section 179 and an additional depreciation write-off once those limits are reached. Prior to this Act, the cap on deductions for equipment purchases stood at $128,000, with the total cost of equipment purchased not exceeding $510,000. But the Economic Stimulus Act of 2008 has significantly bumped these numbers, raising the deduction cap to $250,000 and the total cost limit to a whopping $800,000.

What does this mean for businesses? The message is loud and clear: Invest in your business through equipment purchase or leasing.

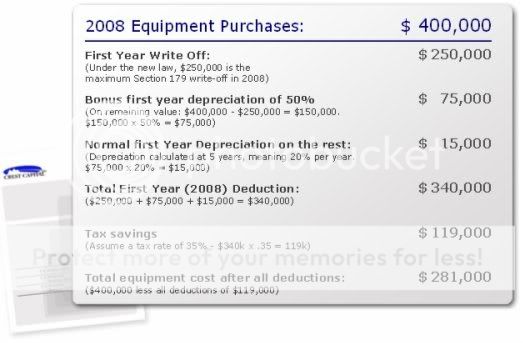

There’s never been a better time to invest in your business’s growth. Just to illustrate the point, consider this example where your business buys $400k of qualifying equipment:

As you can see, this is a big deal. You could get $400k worth of equipment for a net cost of $281k. That’s a saving of $119k! I don’t know about your experiences with your uncles, but it’s not every day that mine offers me a gift of this magnitude. Sure, I remember the old socks, but this is quite a different league.

If you’re interested in exploring these savings further, there are several online Section 179 tax calculators that can help you understand the potential benefit to your business. It’s a brilliant opportunity to make significant strides in your business growth, so don’t miss out.

Happy number crunching, and here’s to your business’s prosperity!