I’ve talked about the beautiful combination of Equipment Financing and Section 179 previously in my blog, but to save you the trouble of searching, I’d just as soon write about it again. Truthfully, just thinking about this make my heart go pitter-patter (they say in springtime, a young man’s fancy turns to love. But in my world, a middle-aged man’s fancy involves equipment purchases and tax deductions… shhh, don’t tell Mrs. Fletch.)

Anyway, on its own, Section 179 absolutely rules. And on its own, financing equipment (or leasing equipment) is a wonderful thing as well. But combining the two together? It can make a ridiculously big difference on your year-end bottom line. Let me show you how.

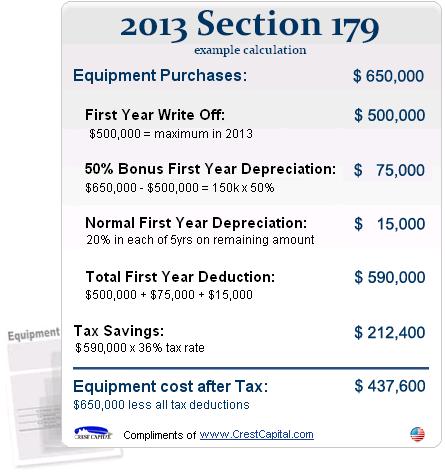

We’ll assume a business that purchases $650,000 in equipment this year. Here are the Section 179 numbers below:

Not bad at all, huh? When all was said and done, they ended up by saving $212,400 in taxes. Those are real, net dollars added back into the company’s coffers.

Hold that “$212k net” thought for a second. Because the IRS is giving you that tax savings no matter how you purchased the equipment. So let’s assume you financed it – you put 100k down, and financed the rest. Then, your 2013 payments will total another 75k.

So you put $175,000 out of pocket in 2013 to buy this shiny new equipment.

But you got back 212k in tax savings (remember, those were real “net” dollars).

$212,400 – $175,000 = $37,400

That’s Thirty Seven Thousand Four Hundred Dollars added to your bottom line this year. PLUS you got all of the equipment right now. Looking at it from a 2013 point of view, it’s like somebody paid you to get new equipment – equipment that will hopefully be used to make more profit next year.

That’s Thirty Seven Thousand Four Hundred Dollars added to your bottom line this year. PLUS you got all of the equipment right now. Looking at it from a 2013 point of view, it’s like somebody paid you to get new equipment – equipment that will hopefully be used to make more profit next year.

This almost makes “too much sense” for many companies. Like they ask “what’s the catch”? There is no catch – this is how Section 179 and Equipment Financing can work together. And like I said at the very top of this post, it’s a marriage made in heaven.