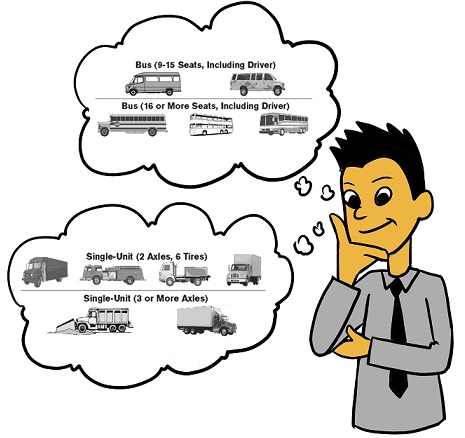

Equipment leases – different types

I’m going to talk a little bit more about equipment leasing, and the different types of leases. I’ve mentioned bits and parts of this before in this blog, but it’s good to revisit these things from time to time for newer readers. For this post, I’ll list each type of equipment lease and a very basic description, and… Read More »